Introduction:

Nestled in the heart of Southeast Asia, Thailand is not only a tourist haven but also a thriving hub for business and finance. With its strategic location, robust infrastructure, and pro-business policies, the country has carved a prominent place on the global economic stage. In this blog, we'll take a deep dive into Thailand's business and finance landscape, exploring the factors that have propelled its economic growth and made it an attractive destination for investors and entrepreneurs alike.

1. Economic Resilience and Growth:

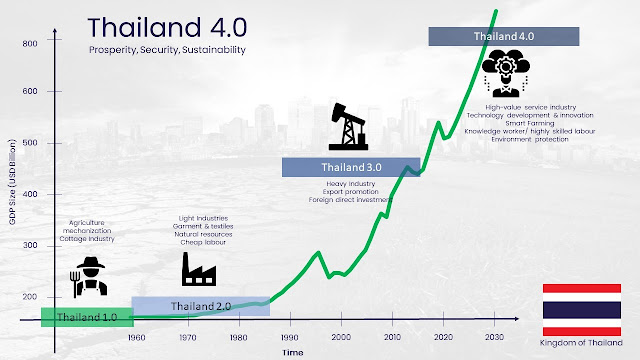

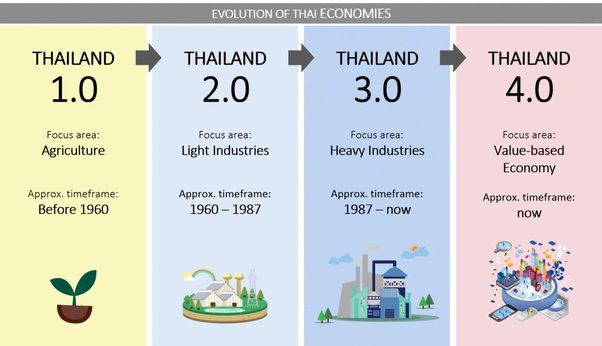

Thailand's economy has demonstrated remarkable resilience, weathering various global challenges. The country's Gross Domestic Product (GDP) growth has been consistently positive, supported by diverse sectors such as tourism, manufacturing, agriculture, and services. The government's proactive measures to stimulate investment and encourage exports have contributed to its economic stability and growth.

2. Strategic Location: Gateway to ASEAN:

Thailand's geographical location at the crossroads of Southeast Asia has endowed it with a strategic advantage. Serving as a gateway to the ASEAN (Association of Southeast Asian Nations) region, the country offers easy access to neighboring markets, making it an attractive base for regional operations and trade.

3. Thriving Manufacturing Sector:

Thailand's manufacturing sector is a key driver of its economic growth. The country's skilled workforce, well-developed infrastructure, and investor-friendly policies have lured multinational corporations to establish manufacturing facilities. From automobiles and electronics to textiles and food processing, Thailand's diverse manufacturing landscape has created a competitive edge in global markets.

4. Booming Tourism Industry:

The tourism sector plays a pivotal role in Thailand's economic landscape. The country's natural beauty, rich cultural heritage, and affordable luxury options attract millions of visitors annually. Popular destinations like Phuket, Bangkok, and Chiang Mai offer a range of accommodations, entertainment, and experiences, contributing significantly to the economy.

5. Infrastructure Development: Fueling Growth Momentum:

Thailand's commitment to infrastructure development has enhanced its competitiveness and attractiveness to investors. Ongoing projects such as high-speed rail networks, modernized ports, and expanded airports streamline transportation and logistics, fostering economic growth across industries.

6. Financial Sector and Investment Climate:

Thailand's financial sector is robust and well-regulated, offering a supportive environment for both local and foreign investors. The Stock Exchange of Thailand (SET) serves as a dynamic platform for companies to raise capital, while the government's investment promotion policies provide incentives to encourage foreign direct investment (FDI) in targeted industries.

7. Digital Transformation and Innovation:

Thailand is embracing the digital age, with a growing emphasis on technological innovation and startups. Government initiatives to promote a digital economy and the emergence of tech hubs like Bangkok's "Silicon Valley" are fostering an ecosystem that encourages entrepreneurship, creativity, and technological advancement.

8. Focus on Sustainable Development:

Thailand recognizes the importance of sustainable development and is actively pursuing environmentally conscious policies. Green initiatives, such as renewable energy projects, eco-tourism ventures, and waste management solutions, demonstrate the country's commitment to balancing economic growth with environmental preservation.

9. Bilateral Trade Agreements:

Thailand's participation in international trade agreements, such as the ASEAN Free Trade Area (AFTA) and bilateral agreements with countries like China, Japan, and Australia, has expanded its market access. These agreements facilitate smoother trade flows, reduce tariffs, and create opportunities for businesses to tap into new markets.

10. Promising Investment Sectors:

Several sectors in Thailand hold great promise for investors looking to capitalize on the country's economic growth. These include renewable energy, healthcare, tourism-related services, agribusiness, and digital technology. These sectors align with Thailand's development goals and present lucrative opportunities for long-term investment.

Conclusion:

Thailand's economic journey is a testament to its resilience, innovation, and determination to achieve sustainable growth. With its strategic location, thriving industries, and investor-friendly policies, the country has positioned itself as an economic powerhouse in the ASEAN region. As Thailand continues to evolve, its commitment to fostering innovation, sustainable development, and a dynamic business environment makes it an irresistible destination for investors and entrepreneurs seeking to be part of its success story. Whether you're a multinational corporation or a visionary startup, Thailand's business and finance landscape offers a world of opportunities waiting to be explored. Embrace the potential, navigate the landscape, and embark on a transformative business journey in the Land of Smiles.

Read more>>

👉 Experience Enchanting Escapes: Unveiling Thailand's Exquisite Gems for Your Perfect Short Getaway

👉 Unveiling Thailand's Breathtaking Wonders: 7 Fascinating Facts That Will Leave You Awestruck

👉 Immersing in Majesty: Unveiling the Mind-Blowing Cultural Tapestry of Thailand

👉 Savoring Thailand's Culinary Symphony: A Journey Through Mouth-Watering Delights

👉 Thailand's Economic Ascendance: Navigating the Business and Finance Landscape

👉 Thailand Unveiled: Navigating the Highs and Lows of Current News

Most Asked Questions by Subscribers:

1. How big is the financial sector in Thailand?

The financial sector in Thailand is significant and plays a crucial role in the country's economy. It includes various segments such as banking, insurance, securities, and capital markets. The exact size may vary over time due to economic conditions, but it's a notable contributor to Thailand's GDP.

2. What is the structure of the financial system in Thailand?

The financial system in Thailand consists of several components, including commercial banks, non-bank financial institutions, capital markets, insurance companies, and the central bank (Bank of Thailand). It is regulated by various government bodies and plays a vital role in supporting economic activities and investments.

3. What is the main business in Thailand?

Thailand has a diverse economy with various industries contributing significantly. Tourism, manufacturing (especially electronics, automobiles, and textiles), agriculture (rice, rubber, and seafood), and services are some of the main business sectors.

4. What is the main income of Thailand?

Tourism, manufacturing exports, and agriculture are among the main sources of income for Thailand. The country's vibrant tourism industry brings in a substantial amount of foreign exchange.

5. Is Thailand richer than India?

As of my last knowledge update in September 2021, Thailand has a higher GDP per capita than India. However, it's important to note that wealth and income disparities can exist within countries, so some regions or individuals in India might have higher income levels than counterparts in Thailand.

6. What is the biggest industry in Thailand?

The manufacturing industry, particularly electronics, automobiles, and textiles, is one of the largest industries in Thailand. Tourism is also a significant contributor to the economy.

7. Which industry is booming in Thailand?

As of my last update, industries like technology, digital services, and medical tourism were showing growth potential in Thailand. However, for the most current information, you should refer to up-to-date sources.

8. Why is Thailand famous for business?

Thailand's strategic location, well-developed infrastructure, skilled workforce, and relatively open investment policies make it an attractive destination for businesses. Additionally, its tourism industry and export-oriented manufacturing sectors contribute to its economic significance.

9. What business can Indians do in Thailand?

Indians can explore various business opportunities in Thailand, including tourism-related ventures, import-export, manufacturing, technology-related services, and more. The specific business possibilities would depend on market demand, regulations, and individual skills.

10. Is INR accepted in Bangkok?

Generally, INR (Indian Rupee) is not widely accepted in Thailand. It's recommended to exchange your INR for Thai Baht (THB) before or upon arrival in Thailand.

11. Which is safer, Thailand, or India?

Safety can vary within different areas of both Thailand and India. Overall, Thailand is often considered to be safer for tourists due to its well-developed tourism infrastructure and relatively low crime rates in tourist areas. However, it's essential to exercise common sense and caution wherever you travel.

12. Is Thailand cheaper than India to travel?

Thailand is generally perceived as more expensive than India in terms of accommodation, transportation, and certain amenities. However, costs can vary depending on the specific locations you visit and your travel preferences. In some cases, certain aspects of travel in Thailand might be more affordable than in India.

Exploring the Flourishing Industries of Thailand

Thailand, a captivating land known for its stunning landscapes, rich culture, and vibrant history, has also earned a noteworthy reputation for its diverse and robust economy. The Kingdom of Thailand has risen as a prominent player in the global business landscape, propelled by a medley of industries that contribute to its economic growth and development. In this exploration, we delve into the top industries that have been shaping Thailand's economic success story.

Tourism: The Crown Jewel of Thailand's Economy

Nestled in Southeast Asia, Thailand boasts an unrivaled allure that draws travelers from across the world. With its pristine beaches, lush jungles, ancient temples, and bustling cities, Thailand is a magnet for tourists seeking unique experiences. The tourism industry has long reigned as the backbone of the Thai economy, contributing significantly to its GDP. From vibrant Bangkok to tranquil Chiang Mai, and the paradise-like islands of Phuket and Koh Samui, Thailand's tourism sector has grown into a multi-billion-dollar powerhouse, creating jobs and fostering cultural exchange.

Manufacturing: Powering Innovation and Exports

Thailand's prowess in manufacturing has elevated it to become one of the world's manufacturing hubs. The nation is a manufacturing leader in sectors like electronics, automobiles, and textiles. International corporations have established a significant presence here, taking advantage of skilled labor, strategic location, and well-developed infrastructure. The automotive industry, in particular, has flourished, with leading manufacturers producing vehicles for both domestic consumption and international markets.

Agriculture: Cultivating Tradition and Export Potential

Deeply rooted in its heritage, Thailand's agriculture sector remains pivotal to its economy. The country is a major exporter of rice, making it a crucial player in global rice markets. Additionally, rubber, seafood, and other agricultural products contribute to Thailand's export revenue. The agricultural sector not only fuels the economy but also reflects the cultural heritage and traditions of the Thai people.

Technology and Innovation: Forging the Future

Thailand's commitment to technological progress and innovation has paved the way for a burgeoning tech industry. The government's initiatives to promote research and development have attracted startups and tech giants alike. The growth of the technology sector is complemented by the rise of digital services, e-commerce platforms, and fintech solutions, transforming the way business is conducted and experienced by the populace.

Healthcare and Medical Tourism: A Global Magnet for Wellness

Thailand's exceptional healthcare infrastructure and skilled medical professionals have fostered the growth of medical tourism. The country is renowned for providing high-quality medical treatments and wellness services at a fraction of the cost compared to many Western countries. International patients flock to Thailand for medical procedures, rejuvenation therapies, and wellness retreats, making the healthcare and medical tourism industry a substantial contributor to the economy.

Energy and Renewable Resources: Pioneering Sustainability

In recent years, Thailand has shown its commitment to sustainability and renewable energy sources. The country's efforts to transition to clean energy have led to a surge in investments in solar power, wind energy, and other eco-friendly solutions. This dedication to sustainability not only addresses environmental concerns but also presents new business opportunities and reduces dependence on fossil fuels.

Conclusion: A Tapestry of Economic Diversity

Thailand's economic landscape is a tapestry woven with threads of diverse industries, each contributing its unique hues to the vibrant whole. From the allure of its tourism to the innovation in its technology sector, Thailand has managed to strike a harmonious balance between tradition and progress. The Kingdom's journey towards economic prosperity continues to unfold, driven by the tenacity, resilience, and dynamism of its industries that set the stage for a promising future.

Unlocking Lucrative Investment Opportunities in Thailand

In the heart of Southeast Asia lies a land of endless possibilities – Thailand. Renowned for its enchanting landscapes, rich cultural heritage, and bustling cities, Thailand has emerged as not only a travel haven but also a thriving investment destination. With a diverse economy and a government committed to fostering business growth, this tropical paradise offers a plethora of investment opportunities across various sectors. In this article, we uncover the enticing investment landscape that Thailand presents and delve into the sectors that hold promise for savvy investors.

Nestled between the Andaman Sea and the Gulf of Thailand, Thailand boasts a strategic location that serves as a gateway to both regional and global markets. The country's stable political environment, pro-business policies, and skilled workforce create an environment conducive to investments. As you embark on your investment journey, let's explore some of the key sectors that offer exciting potential.

Tourism and Hospitality: Capitalize on Thailand's Charm

Thailand's tourism sector is a force to be reckoned with. The nation's captivating cultural attractions, pristine beaches, and vibrant cities continue to lure millions of tourists each year. Investing in hospitality, hotels, resorts, and tourism-related services can yield substantial returns. With the government's emphasis on promoting tourism, your investment in this sector can align with Thailand's upward trajectory.

Real Estate: Building Wealth Amidst Urban Development

Thailand's urban centers are experiencing rapid growth, creating a demand for modern infrastructure and real estate developments. The property market in cities like Bangkok, Phuket, and Chiang Mai offers opportunities for residential, commercial, and mixed-use projects. With an influx of international expatriates and a rising middle class, investing in Thai real estate can be a lucrative endeavor.

Manufacturing and Export: Tapping into Industrial Powerhouses

Thailand's manufacturing prowess is well-known, particularly in sectors such as electronics, automobiles, and textiles. The country's strategic location and well-developed infrastructure make it an ideal base for export-oriented industries. As an investor, you can explore partnerships or set up operations to take advantage of Thailand's skilled workforce and established supply chains.

Technology and Innovation: Riding the Digital Wave

Thailand's commitment to technological advancement is driving the growth of its technology sector. Startups, tech parks, and research centers are burgeoning, offering investment opportunities in areas like fintech, e-commerce, and software development. With a young and tech-savvy population, the technology sector is poised for exponential growth.

Renewable Energy: Investing in a Sustainable Future

Thailand's commitment to sustainability has opened doors for renewable energy investments. The government's incentives for solar, wind, and other green energy projects create a favorable environment for investors seeking to make a positive impact on both the environment and their portfolios.

Healthcare and Medical Tourism: Wellness for Your Investment Portfolio

Thailand's world-class healthcare system and affordability have fueled the growth of medical tourism. Investing in healthcare facilities, medical technology, and wellness services can tap into the global demand for high-quality medical treatments and rejuvenation therapies.

Conclusion: A Land of Opportunities Beckons

As the sun rises over Thailand's stunning landscapes, it illuminates a realm of investment opportunities waiting to be seized. Whether you're drawn to the allure of tourism, the dynamism of technology, or the sustainable future of renewable energy, Thailand offers a spectrum of investment possibilities. With its strategic location, business-friendly policies, and diverse economy, this kingdom is poised to be your gateway to success in the heart of Southeast Asia. As you navigate the investment landscape, remember that the key to reaping rewards is careful research, strategic partnerships, and a vision that aligns with Thailand's journey towards prosperity.

Unveiling Thailand's Economic Landscape: Latest Updates and In-Depth Analysis

In the vibrant tapestry of Southeast Asia, Thailand emerges as an economic powerhouse, where tradition seamlessly blends with progress. As global dynamics evolve, it's imperative to keep a keen eye on the economic pulse of this nation – a land known for its rich culture, breathtaking landscapes, and burgeoning industries. In this comprehensive analysis, we dive deep into the current economic updates of Thailand, shedding light on key trends, challenges, and opportunities that shape its economic trajectory.

Thailand's economy is a reflection of its diverse industries, entrepreneurial spirit, and strategic position in the region. Keeping a finger on the pulse of this economy allows us to discern its growth drivers, potential roadblocks, and areas of promise. With a holistic understanding of the economic updates, investors, policymakers, and enthusiasts alike can navigate the complex economic landscape with confidence.

GDP and Economic Performance: A Snapshot

As of the most recent data, Thailand's GDP has shown resilience amidst global challenges. The economy's performance is marked by a blend of sectors, each contributing its unique flavor. From the robust tourism industry to the manufacturing sector's dynamism, Thailand's GDP continues to display a notable upward trend, driven by domestic consumption, exports, and investment.

Tourism and Travel: Adapting to New Norms

The COVID-19 pandemic had a profound impact on Thailand's tourism, a sector historically significant to its economic growth. The country's response to the crisis, including vaccination campaigns and safety protocols, has been instrumental in reviving the tourism industry. As borders reopen and travelers return, Thailand's tourism sector is poised for a gradual recovery, leveraging its iconic destinations and unique experiences.

Manufacturing and Export: Navigating Global Supply Chains

Thailand's manufacturing sector remains a linchpin of its economy, contributing significantly to export revenue. The electronics, automotive, and textiles industries continue to thrive, albeit with supply chain challenges stemming from global disruptions. The government's initiatives to enhance domestic production capabilities and attract foreign direct investment bode well for the sector's resilience.

Digital Transformation and Innovation: Forging Ahead

Thailand's digital transformation journey is gaining momentum, fueled by a growing tech-savvy population and government support for technology-driven initiatives. The rise of fintech, e-commerce, and digital services paints a promising picture of Thailand's evolution into a digital economy. Investments in startups and tech infrastructure are driving innovation and propelling economic diversification.

Sustainable Development: The Green Path Forward

Thailand's commitment to sustainable development is evident through its efforts to embrace renewable energy sources and reduce carbon emissions. Initiatives to promote clean energy, such as solar and wind power, align with the global push for environmental conservation. These endeavors not only drive economic growth but also position Thailand as a responsible global citizen.

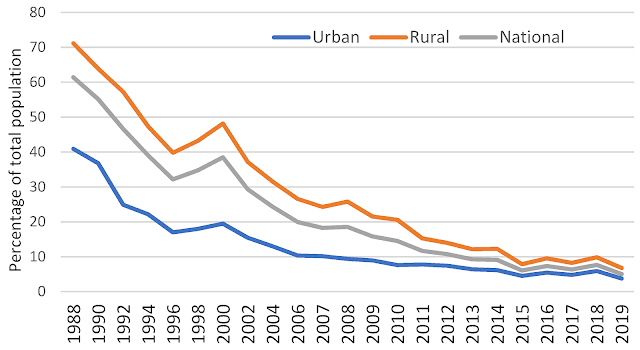

Challenges and Resilience: Navigating Uncertainties

While Thailand's economic landscape exhibits resilience, it's not immune to challenges. Economic disparities, structural vulnerabilities, and external uncertainties underscore the need for prudent policies and strategies. Addressing these challenges requires a balanced approach that encourages inclusive growth, innovation, and adaptive governance.

Conclusion: Paving the Way for Progress

Thailand's economic updates offer a panoramic view of a nation in motion – a nation balancing tradition and modernity, navigating challenges and embracing opportunities. As we dissect the economic indicators and trends, it's evident that Thailand's journey towards sustainable growth is guided by adaptability, innovation, and a commitment to the well-being of its people and planet. Keeping a watchful eye on these economic updates equips us with insights to not only understand Thailand's economic landscape but also to contribute to its progress, prosperity, and global relevance.

.jpg)

.jpg)